You could save upto INR 70,000 on your Home Loan!!!!

Hello Everyone!!!

So have you guessed what you could save by bargaining just 1% reduced rate of Interest with your Banker..??

Here you go..

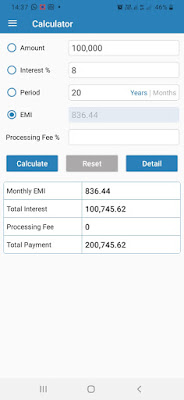

It’s actually very easy to predict. Download EMI Calculator App from the app store and calculate the EMI by entering the details like Principal amount. Rate of Interest and Tenure in months or years whichever is comfortable.

For instance lemme calculate the EMI for you for INR 1Lakh, with different rates of Interest and generally the time period for Home loans is 240 months or 20 Years.

So I entered the details as shown below:

I calculated the EMI values for different Rates as shown below:

There you go, you got to know EMI values for different rate of interests.

My findings here say that on an average we save atleast Rupee 70 every month, for change in rate by just 1%.

So all you need is to calculate what are you paying over the tenure of 20 years - INR 70 * 240months = INR 16800.00

You will be surprised to know, what if you had saved these Rs70 in an RD account (RD rate assumed to be 5.5%) = INR 30490.00

And you will be further shocked to know what if you had invested in a SIP (assuming the general growth rate of 12%) = INR 69247.00

So just by bargaining 1% rate of interest with your financier(banker) you could save upto INR 70,000 for each Lakh of INR.

So be and act wise.

Also lemme know if there is any better investment apart for RD and SIP :)

Will be back by another interesting topic!!

Stay Safe :)

Keep Smiling :)

Always yours

A Bala Manikanta

So have you guessed what you could save by bargaining just 1% reduced rate of Interest with your Banker..??

Here you go..

It’s actually very easy to predict. Download EMI Calculator App from the app store and calculate the EMI by entering the details like Principal amount. Rate of Interest and Tenure in months or years whichever is comfortable.

For instance lemme calculate the EMI for you for INR 1Lakh, with different rates of Interest and generally the time period for Home loans is 240 months or 20 Years.

So I entered the details as shown below:

I calculated the EMI values for different Rates as shown below:

There you go, you got to know EMI values for different rate of interests.

My findings here say that on an average we save atleast Rupee 70 every month, for change in rate by just 1%.

So all you need is to calculate what are you paying over the tenure of 20 years - INR 70 * 240months = INR 16800.00

You will be surprised to know, what if you had saved these Rs70 in an RD account (RD rate assumed to be 5.5%) = INR 30490.00

And you will be further shocked to know what if you had invested in a SIP (assuming the general growth rate of 12%) = INR 69247.00

So just by bargaining 1% rate of interest with your financier(banker) you could save upto INR 70,000 for each Lakh of INR.

So be and act wise.

Also lemme know if there is any better investment apart for RD and SIP :)

Will be back by another interesting topic!!

Stay Safe :)

Keep Smiling :)

Always yours

A Bala Manikanta

Comments

Post a Comment